ATA Carnet

What is ATA Carnet?

ATA Carnet is an international customs document that allows taxableproducttemporary (for up to one year) import duty-free. It consists of unified forms of customs declarations that allow identifying goods that are used at each border crossing point. This is a worldwide guarantee for customs duties and taxes, which can replace the security deposit required by each customs authority. The ATA carnet can be used in several countries on several trips up to the entire validity period

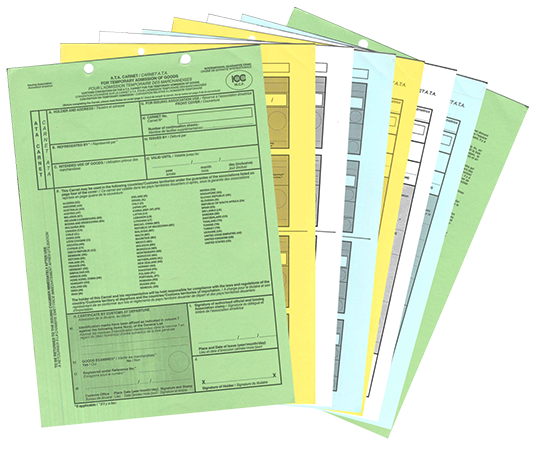

ATA Carnet is an A4 book with a green cover, made up of sheets of different colors depending on the number of operations and countries (but no more than 10 temporary import operations). ATA carnet contains two main types of sheets - tear-off sheets and non-breakable roots.

They have different colors, which vary depending on the type of customs operation:

- green - cover of the ATA carnet;

- yellow - for operations of export from the territory of the Russian Federation and return import;

- white - for importation into the territory of a foreign state and re-export;

- blue - for the transit of goods.

The composition of the carnet is determined by the route and the nature of the operation. At the same time, it is collected together and issued such a number of leaflets of various types that the declarant needs. ATA Carnet is filled in in English or, as directedCCIIn Russia, in another language of the country where the goods are temporarily imported using the ATA carnet.

ATA is an acronym for the French "Admission Temporaire" and English "Temporary Admission" terms denoting temporary importation.

The ATA Carnet is jointly managed by the World Customs Organization (WTO) and the International Chamber of Commerce (ICC) through its World Federation of Chambers.

ATA Carnet allows participants toForeign economic activityminimize the time of customs clearance of goods and reduce the costs associated with the payment of customs duties and customs clearance.

How it all started

In 1955, Charles Aubert (the first director of the Swiss Chamber of Commerce and Industry) conceived the idea of creating a document that simplifies and accelerates the temporary use of goods in another country. He based his idea on the existing bilateral system between Switzerland and Austria. This idea was supported by the Customs Cooperation Council (the predecessor organization of the WTO) and the International Chamber of Commerce (ICC). The Customs Convention on ECS books for commercial samples was adopted and entered into force on 03.10.1957 by joint efforts The World Customs Organization and the International Chamber of Commerce. ECS means the combined English and French words Echantillons Commerciaux - Commercial samples.

In 1961, the WTO adopted the Customs Convention on the ATA Carnet for the Temporary Import of Goods (ATA Convention), which entered into force on 30.07.1963. ATA books are considered an updated version of ECS books, which were no longer limited to commercial samples. More specific agreements for the types of permitted goods were subsequently developed and agreed upon by the WTO .

The States that have signed this Convention are convinced that the adoption of common procedures for the temporary duty-free import of goods will provide significant benefits for international commercial and cultural activities and will ensure a higher degree of harmony and uniformity in customs.

The ATA International System includes77 countries, including 28 EU member states. More than 165 thousand ATA carnets are issued annually in the world. The Russian Federation has been a party to customs conventions on temporary importation under the ATA Carnet since 1995. Since 2012, the ATA carnet has been used in Russia as a customs declaration for temporarily exported goods.

ATA Carnet in Russia

In Russia, the functions of issuing and guaranteeing ATA carnets of the association are performed by the Chamber of Commerce and Industry of the Russian Federation, which is connected with the established international practice, according to which the associations - guarantors of the functioning of the ATA system in the countries participating in customs conventions are, as a rule, national chambers of Commerce, forming the international ATA guaranteeing network of the World Federation of Chambers (WWF).

Russia applies a simplified procedure for customs clearance and customs control of temporary importation for those categories of goods that are regulated by the following annexes of the 1990 Convention to which it has acceded, namely:

- Appendix B.1 "On goods for demonstration or use at exhibitions, fairs, conferences or similar events"

- Appendix B.2 "About professional equipment"

- Appendix B.3 "On containers, pallets, packages, samples and other goods imported in connection with a commercial operation"

- Appendix B.5 "On goods imported for educational, scientific or cultural purposes.

The following goods can be moved on the ATA Carnet

- Goods for exhibitions, showrooms, fairs and other similar events, products necessary for the display and arrangement of the exposition on forums;

- Medical devices and instruments;

- Electronic equipment for repair, testing and testing;

- Samples of new clothing collections;

- Installation, testing, start-up, monitoring and verification equipment for the repair and maintenance of vehicles;

- Business equipment, devices and gadgets (PCs, audio/video devices);

- Devices and devices for photographing (cameras, exposure meters, optics, tripods, batteries, chargers, monitors, lighting equipment, etc.);

- Different types of multi-turn containers.

Regulatory framework:

- Customs Convention on ATA Carnet for Temporary Import of Goods dated 06.12.1961

- Convention on Temporary Importation of 26.06.1990

- Decree of the Government of the Russian Federation No. 1084 dated 02.10.1995 "On the Accession of the Russian Federation to the Customs Convention on the ATA Carnet for the Temporary Import of Goods and the Convention on Temporary Import"

- Order of the Federal Customs Service of the Russian Federation No. 2675 dated December 28, 2012 "On approval of methodological recommendations on the use of the ATA Carnet"

- Order of the Ministry of Finance of the Russian Federation No. 16n dated 31.01.2017 "On Establishing the Competence of Customs authorities to Perform Customs Operations with Goods Transported using ATA Carnets" (as amended. Order of the Ministry of Finance of the Russian Federation dated 31.01.2018 N 17n

- The proforma form of the ATA carnet issued in the Russian Federation is given in Appendix N 1

- Order of the Federal Customs Service of Russia dated 25.07.2007 N 895 (ed. dated 30.07.2012) "On approval of Methodological recommendations on the use of the ATA Carnet" (together with the "Customs Convention on the A.T.A. Carnet for Temporary Import of Goods", "Convention on Temporary Import" (concluded in Istanbul on 26.06.1990))

- Views: 44985

- Government Resolution No. 778 dated 07/06/2018

- Which goods are declared as one product

- Government Resolution No. 2240 dated 07.12.2022

- What is required for DS according to TR CU 009/2011

- What is required for CC or DS according to TR CU 004/2011

- What is required for CC or DS according to TR CU 020/2011

- Customs control of the value of goods